301, Fortune imperia near speedwell party plot,

Field Marshal Rd, Mota Mava,

Rajkot, Gujarat 360005

Toll Free Number

Start your Journey to Financial Prosperity Today by Choosing the Perfect Plan from a Wide Range of MultiBagger Stocks : Join Today

301, Fortune imperia near speedwell party plot,

Field Marshal Rd, Mota Mava,

Rajkot, Gujarat 360005

Toll Free Number

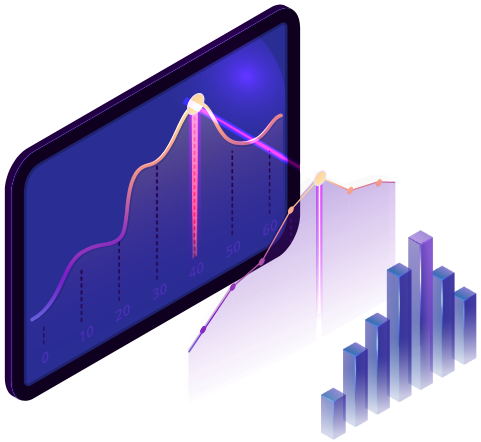

Multi bagger stock.in is stock market investment advisory. Working with a team of experienced stock market advisors will not only help in market research and stock analysis, but will also provide assistance to choose the right multi bagger stock for novice and pro investors alike.

Apart from expert stock market tips, we also make sure to track the movement of your invested stock and keep you updated about the same. Dedicated to serving you with the services in the industry we ensure to keep our process simple, easy and quick to understand and follow.

Moreover, unlike other companies we strictly follow astrological aspects of a company stock before recommending it to our clients.

Quick Links

Get In Touch

301, Fortune imperia near speedwell party plot,

Field Marshal Rd, Mota Mava,

Rajkot, Gujarat 360005

Toll Free Number

18003099953

Future Multibagger Stock © 2024 | Design And Developed By BITNET Infotech